Local Incentives

Radius Indiana and local economic development organizations work directly with businesses to provide information about local incentives.

Regional Impact Fund

Businesses in the Radius Indiana region benefit from the Regional Impact Fund (RIF), which supports area growth and expansion efforts. Learn more here.

Tax Abatement

Tax abatement is offered by local governments in south central Indiana to attract private investment and job creation. Abatement exempts from property tax all or part of the new assessed value or the increased assessed value of a new investment. The exemption is for between 1 and 10 years. In most cases, tax abatement reduces the owner’s property tax bill by about 50 percent over the full abatement period.

Tax abatement can be granted on:

- Real property

- Personal property

- New construction (only to the increase in assessed value attributed to the new construction)

- Property rehabilitation (only to the increase in assessed value attributed to the rehabilitation)

- Any new or used manufacturing equipment that has not previously been taxed in Indiana

- Personal property such as laboratory equipment and computers used in experimental research and development laboratories

Click here to link to our partner Hoosier Energy’s tax abatement estimator, which will allow you to estimate the value of a potential tax abatement in your investment.

Business Incentives

Business incentives help make Southern Indiana an enticing place for your business to locate. Incentives include state tax credits and specialized local opportunities. Our regional and local economic development professionals will guide you through the possibilities and make sure your business receives every incentive it needs.

Federal Tax Credits – New Market Tax Credit

The New Market Tax Credit Program incentivizes community development and economic growth by using tax credits that attract private investment to eligible communities. PDFs are available below for each Radius county to show the credit areas in our region.

- Greene County New Market Tax Credit Map

- Daviess County New Market Tax Credit Map

- Martin County New Market Tax Credit Map

- Lawrence County New Market Tax Credit map

- Orange County New Market Tax Credit Map

- Washington County New Market Tax Credit Map

- Dubois County New Market Tax Credit Map

- Crawford County New Market Tax Credit Map

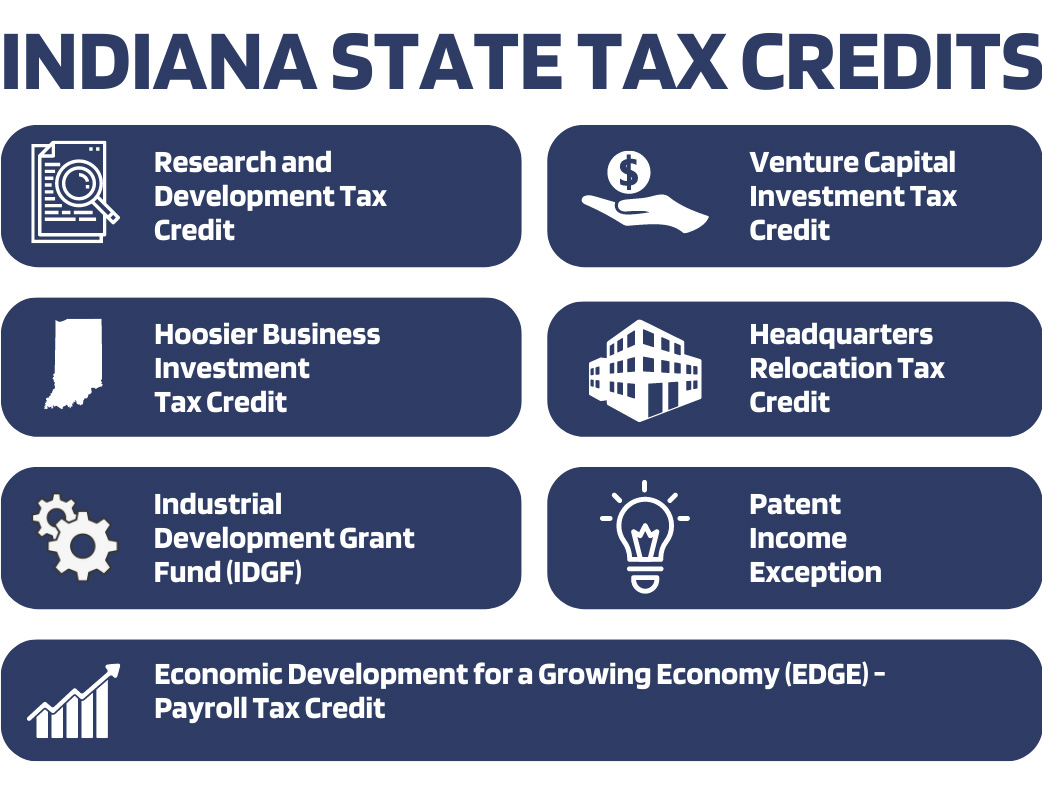

State Tax Credits

Indiana offers many business tax incentives, corporate tax credits, and economic development programs for companies creating new jobs and investments in Indiana. Visit the Indiana Economic Development Corporation to learn more about the tax credits below, including eligibility and an overview.

Research and Development Tax Credit

Venture Capital Investment Tax Credit

Hoosier Business Investment Tax Credit

Headquarters Relocation Tax Credit

Industrial Development Grant Fund (IDGF)

Patent Income Exception

Economic Development for a Growing Economy (EDGE) - Payroll Tax Credit